The Intelligent Leveraged Buyout Investor: A Comprehensive Guide to Maximizing Returns and Mitigating Risks

In the realm of private equity, leveraged buyouts (LBOs) have emerged as a compelling investment strategy offering the potential for substantial returns. However, navigating the intricacies of LBOs requires a high level of financial acumen, analytical prowess, and risk management expertise. This comprehensive article will serve as an invaluable guide for investors seeking to unlock the full potential of LBOs while minimizing associated risks.

Understanding Leveraged Buyouts

LBOs involve acquiring a target company using a combination of debt and equity financing. The acquired company's assets are typically used as collateral for the debt, which is usually non-recourse to the investing partners. The structure allows investors to leverage their capital, potentially amplifying returns if the investment performs well.

5 out of 5

| Language | : | English |

| File size | : | 114 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 65 pages |

| Lending | : | Enabled |

| Paperback | : | 168 pages |

| Item Weight | : | 9 ounces |

| Dimensions | : | 5.25 x 0.42 x 8 inches |

Key Considerations for Intelligent Investors

Embarking on an LBO investment journey demands a thorough understanding of various critical factors:

1. Target Company Evaluation

A comprehensive due diligence process is essential to assess the target company's financial health, industry dynamics, competitive landscape, and management capabilities. This evaluation should encompass historical performance, current operations, and future growth potential.

2. Debt Structure Optimization

The debt financing structure plays a pivotal role in determining the potential return and risk profile of the LBO. Factors to consider include the amount of leverage, loan covenants, interest rate, and maturity schedule.

3. Exit Strategy Planning

Investors should carefully consider potential exit strategies before committing to an LBO. Options include selling the company to a strategic buyer, merging with another entity, or taking the company public through an initial public offering (IPO).

Maximizing Returns and Mitigating Risks

To maximize returns and mitigate risks in LBOs, investors can employ the following strategies:

1. Value Creation Initiatives

Once an LBO has been executed, investors can implement operational and strategic initiatives to enhance the target company's value. These initiatives may include cost optimization, revenue expansion, and debt reduction.

2. Risk Management Framework

A robust risk management framework is crucial to identify, assess, and manage potential risks associated with LBOs. This framework should encompass due diligence, financial modeling, stress testing, and ongoing monitoring.

3. Investor Alignment

Ensuring alignment of interests among all investors is essential for a successful LBO. Transparent communication, clear investment objectives, and performance-based compensation structures can foster collaboration and minimize conflicts.

Case Study: A Successful LBO Investment

To illustrate the principles of intelligent LBO investing, let's delve into a case study:

In 2014, a private equity firm acquired a leading consumer products company through an LBO. The investment thesis was driven by the target company's strong brand recognition, recurring revenue streams, and growth potential in emerging markets.

The investors carefully structured the debt financing, securing a loan with favorable terms. They also implemented value creation initiatives, including operational efficiencies, strategic acquisitions, and marketing campaigns.

By 2019, the company's revenue and profits had grown significantly. The investors successfully exited the investment through a sale to a strategic buyer, generating substantial returns.

Leveraged buyouts offer a powerful investment strategy for sophisticated investors with the financial expertise, analytical skills, and risk management capabilities. By following the principles outlined in this comprehensive guide, investors can unlock the full potential of LBOs while mitigating associated risks.

Remember, LBO investments are not without risks and should only be undertaken after rigorous analysis and prudent decision-making. However, for investors with the necessary knowledge and experience, LBOs can be a lucrative and rewarding investment vehicle.

5 out of 5

| Language | : | English |

| File size | : | 114 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 65 pages |

| Lending | : | Enabled |

| Paperback | : | 168 pages |

| Item Weight | : | 9 ounces |

| Dimensions | : | 5.25 x 0.42 x 8 inches |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Chapter

Chapter E-book

E-book Magazine

Magazine Newspaper

Newspaper Sentence

Sentence Shelf

Shelf Glossary

Glossary Footnote

Footnote Manuscript

Manuscript Classics

Classics Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Archives

Archives Periodicals

Periodicals Study

Study Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Academic

Academic Special Collections

Special Collections Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Reading List

Reading List Book Club

Book Club Theory

Theory Textbooks

Textbooks Thomas Hartman

Thomas Hartman Karen Tei Yamashita

Karen Tei Yamashita Aph Ko

Aph Ko Jules Renard

Jules Renard Martin Iddon

Martin Iddon Salena Godden

Salena Godden Michael Luis

Michael Luis Lucy Hawking

Lucy Hawking Joseph Nevins

Joseph Nevins Bill Kauffman

Bill Kauffman Richard Howells

Richard Howells Pamela D Toler

Pamela D Toler Robert Ford

Robert Ford Tina Stoecklin

Tina Stoecklin Alice Elliott Dark

Alice Elliott Dark Nancy Hughes

Nancy Hughes Armin Trost

Armin Trost Katherine M Marino

Katherine M Marino Elena Maria Vidal

Elena Maria Vidal Avijit Ghosh

Avijit Ghosh

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

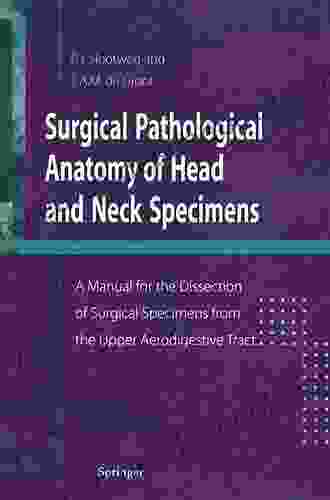

Jedidiah HayesManual for the Dissection of Surgical Specimens from the Upper Aerodigestive...

Jedidiah HayesManual for the Dissection of Surgical Specimens from the Upper Aerodigestive...

Jerry WardSister Sarah Daily Stacks Ttt Pairs Finders3 Charts: Unlocking the Secrets of...

Jerry WardSister Sarah Daily Stacks Ttt Pairs Finders3 Charts: Unlocking the Secrets of... Jordan BlairFollow ·17.6k

Jordan BlairFollow ·17.6k Elias MitchellFollow ·17.3k

Elias MitchellFollow ·17.3k Jamie BellFollow ·3.6k

Jamie BellFollow ·3.6k Fernando BellFollow ·15.5k

Fernando BellFollow ·15.5k Hugo CoxFollow ·17k

Hugo CoxFollow ·17k Kenzaburō ŌeFollow ·2.3k

Kenzaburō ŌeFollow ·2.3k Rob FosterFollow ·6.9k

Rob FosterFollow ·6.9k Braeden HayesFollow ·14.4k

Braeden HayesFollow ·14.4k

Corbin Powell

Corbin PowellMy Little Bible Promises Thomas Nelson

In a world filled with uncertainty and...

Tyler Nelson

Tyler NelsonPolicing Rogue States: Open Media Series Explores Global...

In today's interconnected...

Bret Mitchell

Bret MitchellMusical Performance: A Comprehensive Guide to...

Immerse yourself in the...

Juan Rulfo

Juan RulfoLong Distance Motorcycling: The Endless Road and Its...

For many, the...

Blake Kennedy

Blake KennedyVocal Repertoire for the Twenty-First Century: A...

The vocal repertoire of the twenty-first...

Eric Hayes

Eric HayesOne Hundred and Ninth on the Call Sheet! The Enigmatic...

In the vast panorama of Western films,...

5 out of 5

| Language | : | English |

| File size | : | 114 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 65 pages |

| Lending | : | Enabled |

| Paperback | : | 168 pages |

| Item Weight | : | 9 ounces |

| Dimensions | : | 5.25 x 0.42 x 8 inches |